Detroit City Council approves tax reduction program to support the development of affordable housing

On October 29, 2024, the Detroit City Council unanimously adopted an ordinance to expand its “Payment in Lieu of Taxes” (PILOT) program for the creation and preservation of affordable housing in Detroit. Under the amended program, Detroit will be able to approve a PILOT for development and rehabilitation projects that will provide affordable or workforce housing units to expanded categories of low- and moderate-income households in Detroit, supplementing the HUD or MSHDA supported projects that had been the only categories of projects eligible for a PILOT in Detroit and throughout the State of Michigan prior to a recent change in state law.

A PILOT replaces traditional ad valorem property taxes with a service charge based on a percentage of rental revenue, which both reduces a project’s tax burden and provides stability to projects that are often rent restricted and unable to absorb significant fluctuations in operating expenses. PILOTs are a critical tool for developers, investors and lenders seeking to finance and develop affordable housing.

Highlights of the amended program, known as the Fast Track PILOT, include:

- Program eligibility extends to workforce housing that is affordable to and occupied by households earning up to 120% of the area median income (AMI). The 2024 120% AMI in southeast Michigan ranges from $80,640 to $115,080 for a family of 1-4 people.

- The amount of PILOT payments will be determined based on the levels of affordability in the project. Projects with greater numbers of deeper levels of affordable units will have PILOT rates as low as 1% of rental revenue, with PILOT rates increasing based on a project’s affordability commitments. Rehabilitations of structures vacant for at least five years will be eligible for a PILOT rate 50% lower than the rate otherwise provided for the applicable level of affordability.

- Projects that target low-income households (earning 80% of AMI or less) will be eligible for PILOT approval under a streamlined underwriting and administrative approval process that is estimated to reduce the City’s review and approval timeline. PILOT approvals for projects committing to affordability for moderate-income households (households earning up to 120% of AMI) ("workforce housing") will require City Council approval following an expected streamlined review process.

- The PILOT term usually will be 15 years with the possibility of up to two 15-year renewal periods.1

- Under City guidelines to be issued in the near future, a developer is expected to be required to invest at least $15,000 per unit for initial PILOT approval and to invest at least $6,000 per unit for approval of a renewal period.

- The City guidelines may include provisions for conversion from other abatements (e.g., NEZ or OPRA) to a PILOT during or after expiration of the existing agreement, subject to conditions expected to be included in the guidelines.

- The City guidelines are expected to require evidence of capability to proceed with the project.

- Developers and owners will be subject to restrictive covenants and an agreement with the City regarding the continued maintenance of affordability throughout the term of the PILOT. Restrictions on increases of rent rates for existing low-income tenants as of the date of rehabilitation and other tenant protections are expected to be included in the guidelines and the required agreement.

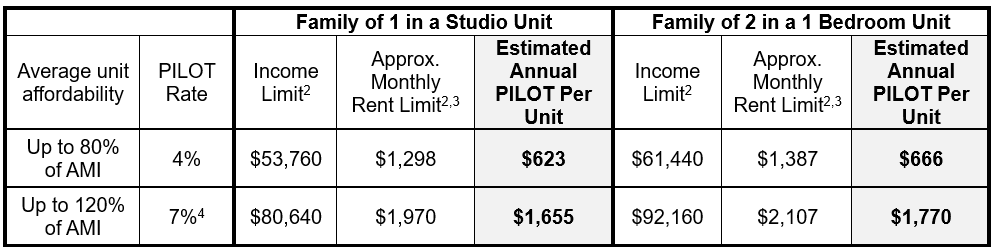

The table below outlines approximate PILOT-eligible affordability levels, corresponding Fast Track PILOT rates, and related estimated rent and income restrictions based on 2024 AMI amounts:

For affordable housing projects, unabated property taxes, which are based on the taxable value of the property, often can equate to 10% or 20% of rental income in Detroit. The PILOT rates shown above in most cases would result in a significant reduction of the tax burden during the PILOT term.

Both state and many local governments are keenly focused on addressing critical affordable housing supply challenges across Michigan. The Fast Track PILOT is one part of the City’s affordable housing toolbox and, along with programs such as the newly established Housing Tax Increment Financing (TIF) component of the brownfield TIF program, aims to encourage the accelerated development and preservation of stable and affordable housing.

If you are considering or interested in the Detroit PILOT program or other development incentives for multifamily residential developments, acquisitions, or rehabilitation projects in Detroit or across Michigan, please contact Richard Barr (rbarr@honigman.com), Corey Levin (clevin@honigman.com), Steve Rypma (srypma@honigman.com) or your Honigman attorney with any questions and for additional information.

Contact us at rcooper@honigman.com if you would like to receive additional alerts and updates on this topic.

[1] Note that it is possible that state law limits the duration of a PILOT term to 15 years.

[2] Income and rent are based on 2024 HUD limits. Limits are subject to change in future years.

[3] Rent limits included above are adjusted based on approximate MSDHA utility allowances, resulting in the required adjustment varying based on location and types of appliances, furnaces and other equipment in an apartment and which utilities are paid directly by the tenant. If utilities are included in rental rates, then rent limits should be higher than noted above.

[4] Rate included as an illustrative example. PILOT rates for housing projects where the average affordability of units is to households earning between 81% and 120% of AMI are pending adopted City administrative guidelines. The available PILOT rate for this level of average affordability is expected to be approximately 7% to 10%, subject to negotiation with the City and approval by the City Council.

Related Professionals

Related Services

Media Contact

To request an interview or find a speaker, please contact: press@honigman.com